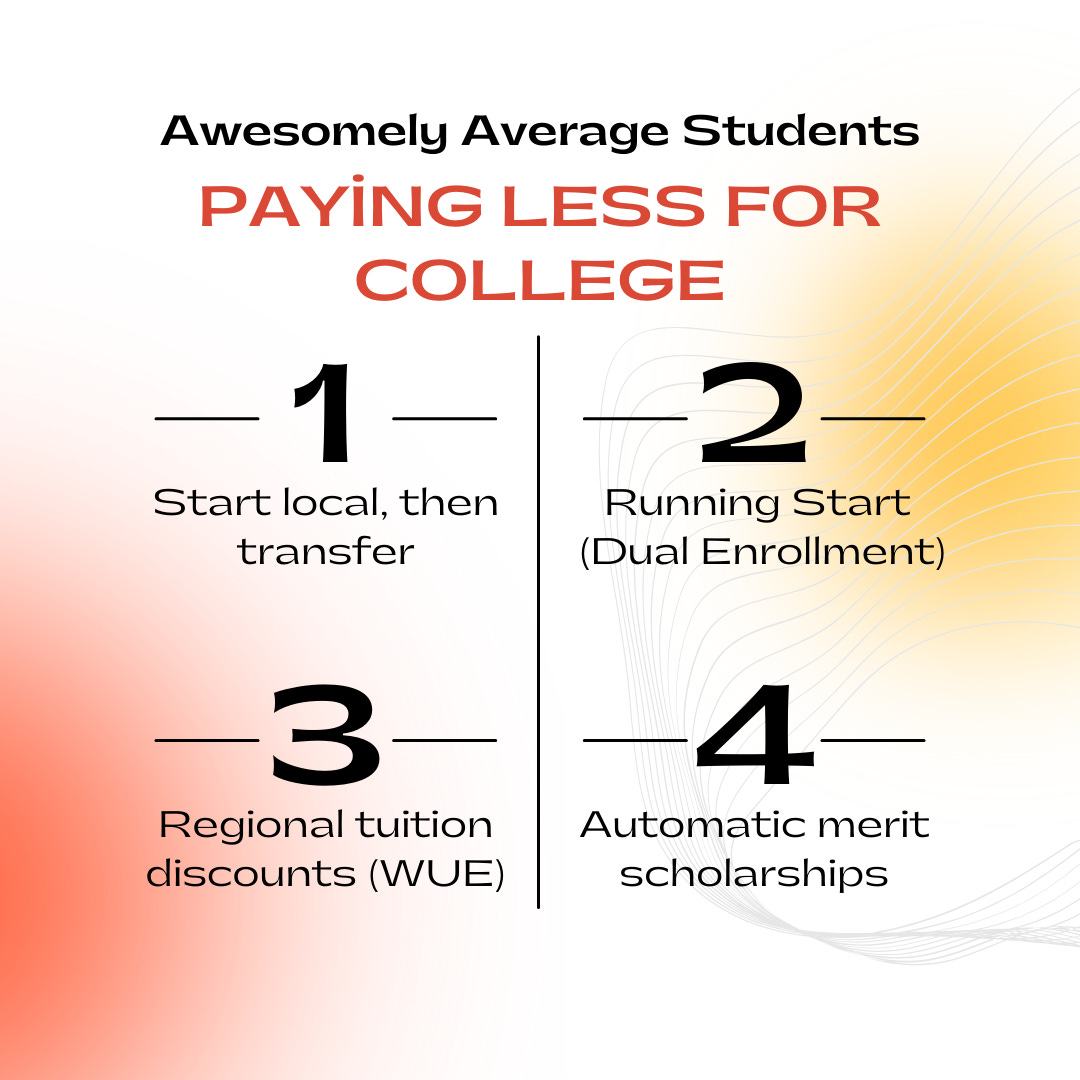

How to Pay Less for College: 4 Strategies for Awesomely Average Students

Paying less for college doesn’t always mean chasing after private scholarships or having a perfect application. Sometimes, the smartest strategy is simply knowing the options.

There is a lot of advice out there about how to land big scholarships and huge discounts for college, particularly academic and athletic scholarships.

This is great for students who excel in these areas. But what if you’re a solid, good-enough student — not a 4.0 genius, not a state champion, just… average (and awesome)?

Good news: You still have real ways to save. Here’s what you need to know.

1. Start at a Local College, Then Transfer

Attend a local community college for 1–2 years, then transfer to finish your degree at a 4-year college.

This strategy can save you significant money. The average in-district community college tuition is about $4,000/year compared to $11,000+/year at public four-year colleges (College Board, Trends in College Pricing 2024). Going to college locally also saves on room and board, too.

Many state universities have guaranteed transfer pathways (e.g., California’s TAG program or Washington’s Direct Transfer Agreements) making it easier to move into a 4-year school without losing credit.

Transferring can often times get you admitted to colleges you might not otherwise have been able to get into straight out of high school. College systems often have “budgets” for transfer students - a set target for a large number of admitted students via the transfer pathway. An example… UCLA has an acceptance rate of ~9% for high school seniors, but a transfer pathway with an acceptance rate of 23% (UCLA admissions). University of Washington has a 69% acceptance rate for students from Washington State Community Colleges (UW admissions).

Using your freshman year of college to establish a solid academic foundation and GPA can set you up for success in college. Many students find that getting off to a good start is very doable at local colleges.

2. Take Advantage of Running Start (or Dual Enrollment)

High school juniors and seniors, take real college classes at a local college — for free or low cost.

This allows you to cut the amount of time you’ll need to spend in college, sometimes by years.

You do this by earning college credits right now, while you’re still in high school. The courses you take count towards graduating high school and graduating college.

Earn college credit before you graduate high school. In some cases, you can finish a full associate’s degree while still a high schooler.

Families can save thousands of dollars on college tuition. For example, in Washington State, Running Start covers tuition costs for up to two years of college-level coursework. High school students generally end up paying only about $300 a quarter in fees (much less than even Community College tuition).

For awesomely average students, running start classes can often be a more reasonable and accommodating college-level prep pathway than AP classes and/or the IB programme, both of which can come with very demanding workloads and pressure-filled exams.

3. Use Regional Tuition Discount Programs

You don’t always have to pay full out-of-state tuition to attend a public university far from home.

Examples:

Western Undergraduate Exchange (WUE): Students from 16 Western states can attend participating schools at 150% of in-state tuition, not the full out-of-state price. See my previous post.

Other Programs: Look into the Academic Common Market (South), Midwest Student Exchange, and New England Regional Student Program if you live outside the West.

Important Note: Not every major at every school qualifies. Check program-specific lists carefully.

4. Look for Colleges with Automatic Merit Scholarships

Some colleges award merit aid automatically based on GPA and/or test scores — no extra application needed. And the starting thresholds at some universities are lower than you might think.

How It Works for “Average” Students: Some schools offer awards starting at a 3.0 GPA and/or test scores above the national average (around 1200 SAT or 25 ACT).

Two Examples: the University of Mississippi (Ole Miss) and the University of Wyoming ← these are both state flagship universities!

Pro Tips: Focus on colleges where your GPA/test scores are above the school’s average, as that’s where you’re most likely to get money. And, some scholarships have priority deadlines. Applying early can increase your chance.